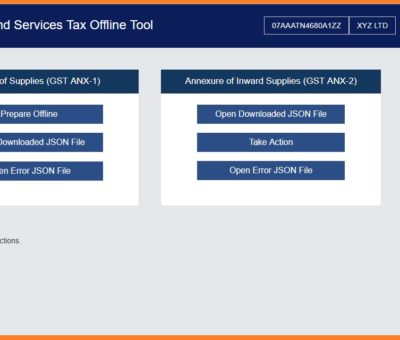

New type of GST Return filing, A normal taxpayer would have to file proposed gst return with below forms FORM GST RET-1 (Normal) or FORM GST RET-2

Read MoreA recognised Startup can avail various benefits including: Section 80-IAC of Income Tax benefit: Income Tax exemption for 3 years post approva

Read MoreNIDHI COMPANY- UNDER COMPANIES ACT 2013 Section 406 of Companies Act 2013 and Companies (Nidhi Companies) Rules, 2014 governs The Law and Procedure

Read MoreRegistration of the GST, ESI, EPF) under MCA efficetive from 31st March 2019 Big Update: GST/ESIC/EPFO Registration can be obtained at the time o

Read MoreRemoval of Disqualification of Directors under CODS 2018 CODS 2018 : Condonation of Delay scheme 2018. The removal of Disqualification of

Read More _atrk_opts = { atrk_acct:"mkpwr1WyR620WR", domain:"ezzus.com",dynamic: true}; (function() { var as = document.createElement('script'); as.type = '

Read MoreReserve Unique Name(RUN) Reserve Unique Name(RUN) service launched by MCA(Ministry of Corporate Affairs), Government of India on the occasion of 6

Read MoreE Way Bill - Overview E Way Bill will come into effect from 1st February 2018 for smoother, swifter and easier inter0state movement of goods. E Wa

Read MoreMSME Registration in Delhi, India Benefits of MSME Registration: Collateral Free loans from banks Special consideration on international trade fa

Read MoreBackend Updation of DIN by RoC in case all the existing director of the company are Disqualified U/S 164 (2)(A) of Companies Act 2013. The MCA h

Read More