HOW TO BE DEALT WITH THE COMPANIES WHEN ALL THE EXISTING DIRECTORS OF THE COMPANY ARE DISQUALIFIED U/S 164 (2)(A) OF COMPANIES ACT 2013. (or) How

Read MoreQuick Reference to " One Person Company " :- Legal Provision:- 2(62), 193 of Companies Act, 2013. Rule 3 (1), Rule 4, of Companies ( Incorpor

Read MoreKey-take away from 22nd Meeting of GST Council: 1. In order to ease the compliance burden of SME Sectors, following amendments has been recommended:

Read MoreNEW GST UPDATE AND RULES IMPLEMENTED ON 6TH OCTOBER 2017 1. To facilitate the ease of payment and return filing for small and medium businesses with

Read MoreCompliance Calender of Good and Service Tax(GST) In India : Last date of GST Return Form Submission : March 2018 GSTR 3B : 20th April 2018 GST

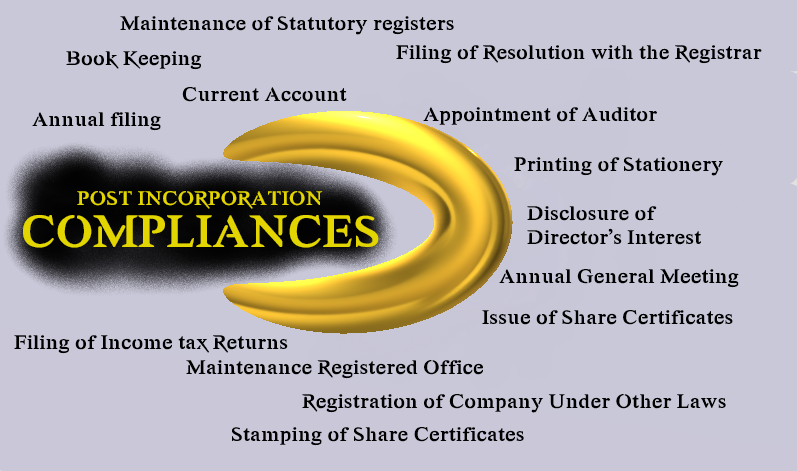

Read MorePost Incorporation Compliances When you read this article, your company registraion certificate already in your hand. Your new private compa

Read MoreWe are hereby providing you the comprehensive guide for first compliance required to be completed after incorporation : Opening of Current Bank Acc

Read MoreProcedure for Revival/ Restoration of Struck off Companies under section 248 of the Companies Act (the Act) 2013 through NCLT, 2017. Greetings of the

Read MoreCompanies can start uploading their sale invoice from 24th july on GST Portal. Invoices could generated from 1st July under GST with GSTN Number.

Read MoreCLASS 1 : Chemicals used in industry, science and photography, as well as in agriculture, horticulture and forestry Chemicals used in science and

Read More