Filing an Income Tax Return (ITR) is a mandatory obligation for individuals whose income exceeds the specified threshold limits in India. Here’s a com

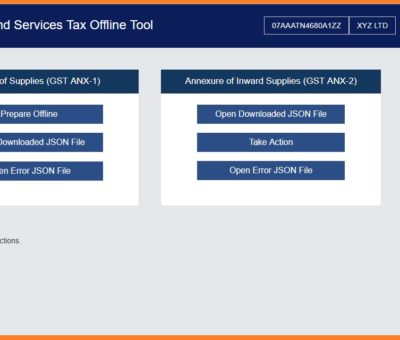

Read MoreNew type of GST Return filing, A normal taxpayer would have to file proposed gst return with below forms FORM GST RET-1 (Normal) or FORM GST RET-2

Read MoreE Way Bill - Overview E Way Bill will come into effect from 1st February 2018 for smoother, swifter and easier inter0state movement of goods. E Wa

Read MoreKey-take away from 22nd Meeting of GST Council: 1. In order to ease the compliance burden of SME Sectors, following amendments has been recommended:

Read MoreNEW GST UPDATE AND RULES IMPLEMENTED ON 6TH OCTOBER 2017 1. To facilitate the ease of payment and return filing for small and medium businesses with

Read MoreCompliance Calender of Good and Service Tax(GST) In India : Last date of GST Return Form Submission : March 2018 GSTR 3B : 20th April 2018 GST

Read MoreCompanies can start uploading their sale invoice from 24th july on GST Portal. Invoices could generated from 1st July under GST with GSTN Number.

Read Moregst due dates are 3 in a next month : 10th of next month for 1st form, 15th of next month for 2nd form and 20th of next month for final final return;

Read MoreGst registration migration will be open from 1st july to next 3 months. So, No need to warry for who, not get migration under gst of vat/tin and servi

Read MoreGst registration migration will be open from 1st july to next 3 months. So, No need to warry for who, not get migration under gst of vat/tin and servi

Read More