E Way Bill – Overview

E Way Bill will come into effect from 1st February 2018 for smoother, swifter and easier inter0state movement of goods.

E Way Bill is required where movement ogfgoods with consignment value, exceeding Rs.50,000/- is involved.

Objective of E Way Bill :

Single e-way bill for hassle-free movement of goods throughoutthe country.

Noneed for seperate transit pass in each state for movement of goods.

Shift from departmenta-policingmodel to self declaration model for movement of goods.

Benefits of E Way Bill System :

Taxpayers/transporters need not visit any tax Office/checkpost for generation of e-way bill/movement of goods across states.

No waiting time at checkposts and faster movement of goods thereby optimumuse of vehicles/resources, since there are no checkposts in GST regime.

User-friendly e-way bill system.

Easy and quick generation of e-way bill.

Checks and balances for smooth tax administration and process simplification for easier verification of e-way bill by Tax Offices.

Legal provisions and Exemptions from E Way Bill :

E Way Bill portal, main features :

User can create masters of his Customers, Supliers and Products for easy generation of e-way bill.

User can monitor e-way bills generated on his account/behalf.

Muliple modes for e-way bill generation for ease of use.

User Can create sub-users and roles on portal for generation of e-way bill.

Alerts will be sent to users via mail and sms on registered mail id/mobilenumber.

Vehicle Number can be entered either by the supplier/recipient of goods who generates e-way bill or the transporter.

QR code will be printed on each e-way bill for ease of seeing deails.

Consolidated e-way bill can be generated for vehicle carring multiple consignments.

How to register for E Way Bill :

Register on goverment official webiste : ewaybill.nic.in with information

- First, Enter GST Registration Number

- OTP will receive on mobile or EMail

- After verification with otp, you need to check all details.

- Creation of New Userid and Password

- Login with New Userid and Password.

- Generate New Eway Bill or others.

Modes of generation of E Way Bill, modification and cancellation of E Way Bill :

Web- Online using browser on laptop or desktop or phone etc.

Android based Mobile App on mobile phones.

Via SMS through registered mobile number.

Via API (Application Program Interface) i.e. integration of IT system of user with e-way bill system for generation of e-way bill.

Tool-based bulk generation of e-way bills.

THird-Party based system of Suvidha Providers.

Extension of validity of E Way Bill :

Verification of E Way Bill :

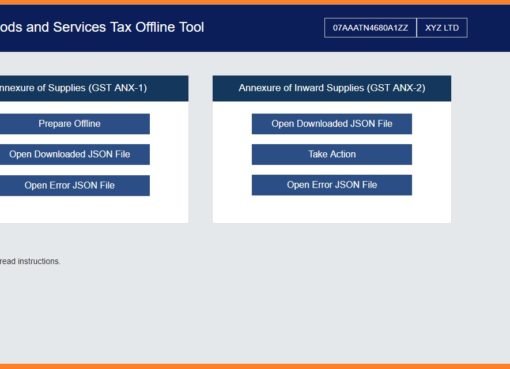

Demonstration :

Q&A :

What is e way bill

E Way Bill System

e waybill rules

e way bill in rajasthan

gst e waybill

thanks for sharing you blog that share how to use and hoe to apply e way bill thanks .

This was a wonderful read. Thank you.